The process of understanding your paycheck requires you to navigate through three different components which include taxes and deductions and benefits. Employees become confused when they observe the difference between their gross pay and the actual amount that banks deposit into their accounts.

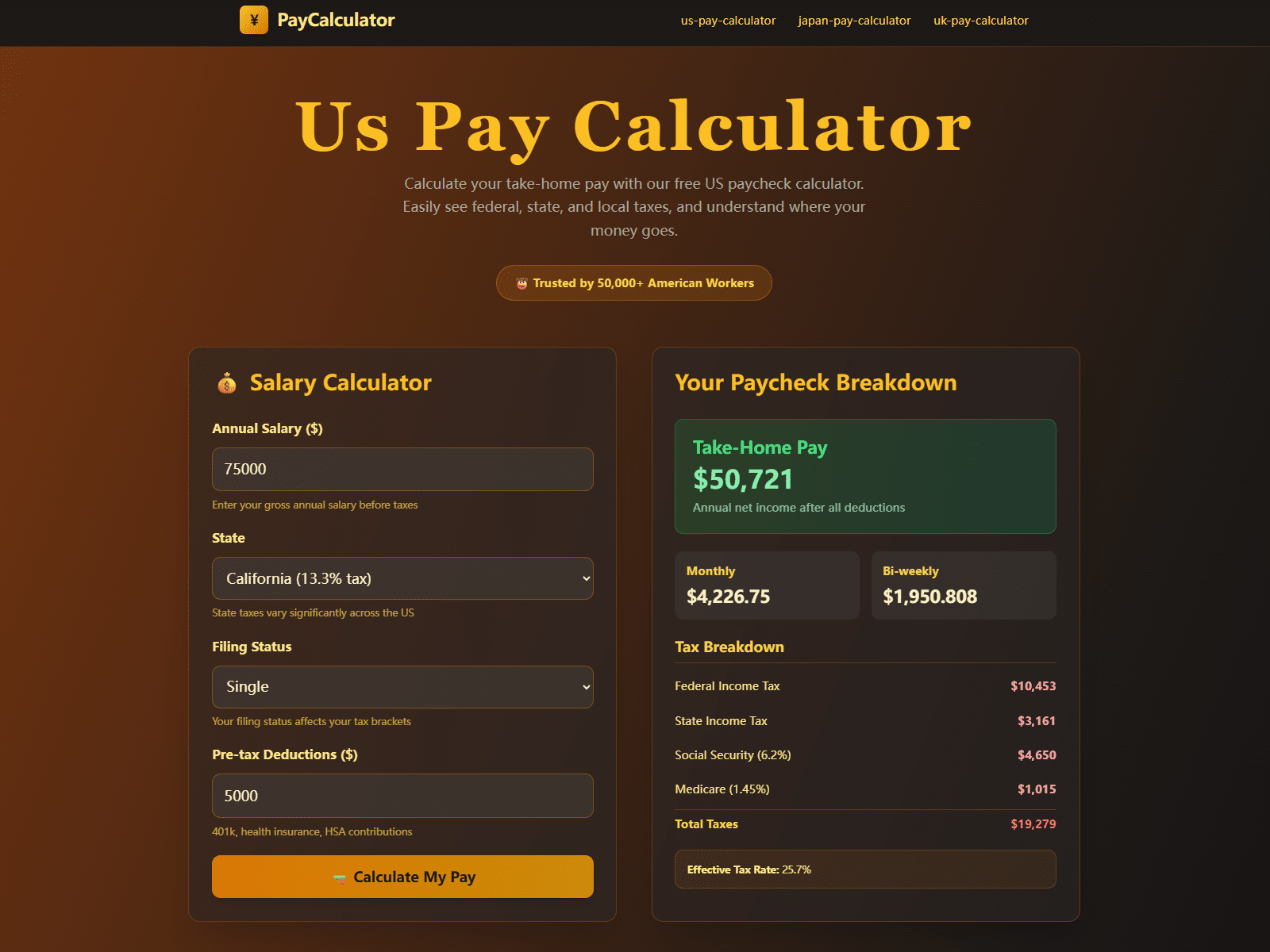

Paycalculator provides an efficient solution to this task by delivering precise and immediate calculation results which benefit both employees and employers. Paycalculator transforms your financial activities because it enables you to budget your expenses and determine salary negotiations and track your spending.

Understanding the Basics: Gross vs. Net Salary

Before exploring Paycalculator functions, people need to learn about the distinction between gross salary and net salary. Employees receive their complete earnings through gross salary which remains unaltered by any deductions. The total sum includes base wages together with bonuses and overtime pay and all other taxable employee benefits.

Net salary represents the sum which employees receive after all deductions which include tax payments and retirement savings and other legally required withholdings. Understanding this difference between gross and net salary provides essential information for anyone who wants to assess their financial condition.

The gross to net salary US calculators provide users with their most helpful function in this specific situation. Users can enter their gross income which the system instantly calculates as their posttax earnings while considering all federal and state and local tax rates and Social Security and Medicare and retirement deduction requirements. Employees in the United States need to understand these figures because they play a central role in their personal financial management activities.

Best Importance of Accurate Tax Calculations

The payroll system becomes most difficult for workers because of its complex tax requirements. Employees often wonder why such a significant portion of their paycheck disappears seemingly overnight. The U.S. deduction system includes FICA as its main deduction, which stands for the Federal Insurance Contributions Act. The FICA taxes exist to fund Social Security and Medicare because all employees must pay into these vital social programs.

Employees and employers can use a FICA calculator to determine their total program deductions. Accurate calculations are not just a convenience—they are a necessity. Tax underestimation brings penalties while people who overestimate taxes will receive lower pay, which will disrupt their financial schedule and planning. Paycalculator simplifies this process by providing detailed breakdowns, showing exactly how each deduction affects your net salary.

Who Benefits from Paycalculator?

People who will gain advantages from Paycalculator include employees who want to learn about their paychecks and employers and freelancers and HR professionals because of the precise calculations which they can obtain through the tool.

Through Paycalculator employees obtain tools which help them track their earnings and create expense budgets and select their retirement and benefits packages.

Freelancers and contractors who manage their own taxes can use Paycalculator to forecast their upcoming quarterly tax payments which helps them prepare for tax season without any unexpected costs.

The tool enables employers and HR professionals to automate payroll operations while they verify tax compliance and deliver detailed payroll information to employees which helps to decrease misunderstandings and staff questions.

Planning Your Financial Future

The starting point of financial literacy requires people to comprehend their income sources. The Paycalculator tool enables you to evaluate your gross and net salary which helps you create budget plans and choose investment options and savings methods. The process of identifying tax and benefit deductions lets you discover ways to boost your retirement savings and adjust your tax withholdings for better net income results.

The tool Paycalculator lets users create custom financial models to test different scenarios. The calculator shows you how a 10 percent increase in your salary will affect your total earnings after taxes. The retirement contribution calculator shows you how your retirement contribution changes your total paycheck. Paycalculator provides these insights instantly, giving you the knowledge you need to make smarter financial decisions.

Embracing Technology for Financial Transparency

The development of advanced payroll systems has occurred because technology now influences all parts of human existence. The Paycalculator tool enables anyone with access to a computer or smartphone to operate complex financial calculations which it provides through its accurate financial tools.

Paycalculator simplifies difficult payroll tasks while displaying complete pay details which help people become more confident about their financial situation and decrease their anxiety while making better decisions about their money.

Conclusion

Your salary statement should not require you to decipher an unknown code.Employees and employers now possess better tools to handle complex salary systems and tax regulations and deduction processes because Payroll calculators such as Paycalculator have become more popular.

Paycalculator provides accurate FICA calculator results and complete US gross-to-net salary conversion results which help users understand their financial situations.

The adoption of this technology enables your business to obtain numerical data together with operational understanding and organizational control and mental relaxation. Paycalculator serves as an essential tool for building financial understanding in today’s society whether you need to plan your budget or negotiate your salary or track your spending.