Simply knowing your net paycheck as a W-2 employee involves complicated federal, state, and payroll tax credits. This is now much simpler with modern tax calculators that work automatically to calculate your take-home pay after all the deductions, so you can have financial clarity to budget, negotiate jobs, and also do personal long-term planning. This guide will detail how such calculators actually work and why they are necessary to all American workers.

What Is Different About the W-2 Tax Calculations?

W-2 workers also enjoy an organized payroll deduction, which is not the case with independent contractors. Your employer is withholding taxes even before you get your paycheck, and it is important to estimate properly to do financial planning.

Essential Elements of W-2 Tax Withholding

Net salary calculator USA will include the following key deductions:

- Federal income tax according to the tax brackets of the IRS (10-37% in 2026).

- FICA taxes amounting 7.65% (6.2% Social Security and 1.45% Medicare)

- The state income tax rate is 0 to 13.3%.

- Local taxes in some cities and counties.

- Pre-tax deductions included in 401(k) and health insurance premiums.

As per the IRS data on the tax, a typical American employee ends up paying about 22%-25% of gross income as federal and FICA taxes on top of the state taxes.

How Do W-2 Tax Calculators Work?

Modern pay calculators rely on elaborate algorithms that are reflective of IRS withholding rules and state taxes.

The Calculation Sequence

Step 1: Gross Income Input: You type the amount of earnings per year, how much you will earn per hour, or how much you will earn per pay period. The calculator converts this to a standard format, allowing for precise taxable income calculation.

Step 2: Pre-Tax Deductions: This system deducts contributions to 401k and HSA deposits, health insurance premiums, and others out of your gross pay. These bring about an immediate reduction in your taxable income, which reduces your total tax liability.

Step 3: Federal Tax Computation: Based on your filing status (single, married, head of household), the website uses a progressive tax rate. It will look like this: a given filer with an income of $65,000 will pay 10% on the first $11,925, then 12% on the amount of $48,475, and 22 percent thereafter. Such a system of marginal tax rates will provide equitable taxation at all levels of income.

Step 4: FICA Tax Application: Social Security Tax is shown on the first $176,100 of wages in 2026 (inflation-adjusted). There is no wage limit for Medicare tax, and there is an extra charge of 0.9% of Medicare tax on high earners who earn above $200,000. These are payroll taxes that finance important government initiatives.

Step 5: State and Local Taxes: Geographic-specific rates would depend on where you are working. The maximum rate in California is 13.3%, and Texas has no state income tax. There are more local tax requirements of cities such as New York City.

Step 6: Final Subtractions: Post-tax deductions, Roth 401k, garnishments, and union dues do not change any amount of taxable income but take their toll on your net pay.

Free vs. Premium Tax Calculators: Which Is Right for You?

Feature | Free Calculators | Premium Tools (like Salary-Calculator.ai) |

|---|---|---|

Federal Tax Accuracy | Standard brackets | Real-time IRS data integration |

State Coverage | 15-30 states | All 50 states and territories |

Update Frequency | Annually | Quarterly or as laws change |

Deduction Options | 3-5 basic types | 25+ deduction categories |

Multi-State Support | Limited | Full support for remote workers |

Reporting Features | Simple summary | Detailed breakdowns, PDF exports |

Tax Credit Integration | None | Child tax credit, EITC calculators |

Cost | Free | Starting at $0-$25/month |

According to a 2026 American Payroll Association study, 71% of employees do not entirely understand their pay stubs, resulting in errors in their financial planning, which on average costs their family about $2850 per year.

Real-World Example: Calculating Take-Home Pay

Consider Jack, an SEO expert in Austin, Texas, earning $92,000 annually:

Gross Annual Salary: $92,000

Pre-Tax 401(k) Contribution: $6,900 (7.5%)

Pre-Tax Health Insurance: $2,640

Adjusted Gross Income: $82,460

Federal Income Tax: ~$13,245 (effective rate 14.4%)

Social Security Tax: $5,704 (6.2%)

Medicare Tax: $1,334 (1.45%)

State Income Tax: $0 (Texas)

Annual Net Pay: $61,177

Monthly Take-Home: $5,098

Biweekly Paycheck: $2,353

Using a net salary calculator US, Jack immediately sees that he retains about 66.5% of his gross income—important data in his plans to rent, pay for his car, and plan disposable income.

How Does Salary-Calculator.ai Improve W-2 Calculations?

It is a global salary calculator platform, which has country-specific calculators (France, Germany, Japan, the UK, the US, and China). The US calculator is a particular change in W-2s in that it:

- Including tax regulations of all 50 states, to include quarterly updates in 2026.

- Cities’ tax and county tax accounting in 350+ regions.

- Offering cross-location salary comparisons.

- Provision of scenario planning of job offers in terms of cost-of-living-adjusted salary rates.

- Preparing comprehensive reports that are categorical in the breakdown of tax paid.

- Retirement contribution affects the pre-tax and post-tax income.

The platform ensures you receive accuracy that free tax calculators cannot match by combining real-time tax law monitoring with AI-powered data analysis. The system automatically adjusts for changes in tax brackets, FICA limits, and standard deductions ($14,600 for single filers in 2026).

Key Takeaways

- The W-2 tax calculators apply federal, state, and FICA taxes as well as local taxes into the calculation to approximate how much you will actually take home with 96% accumulation using the new 2026 tax tables.

- Available deductions, such as 401(k) and health insurance, reduce your taxable income, which is, in turn, computed before calculating any tax, and maximize your net pay.

- Your tax status, place of residence, and whether to receive benefits or not can greatly affect the ultimate amounts of net pay, by a difference of up to $10000/year.

- Advance salary calculators provide all the coverage in the state, tax integration, and frequent updates that are not available in free ones.

- You can budget without making mistakes and be able to negotiate job offers clearly with a full breakdown of the disposable income by understanding its real amount.

Best Payroll Tools for Fast and Accurate Salary Processing

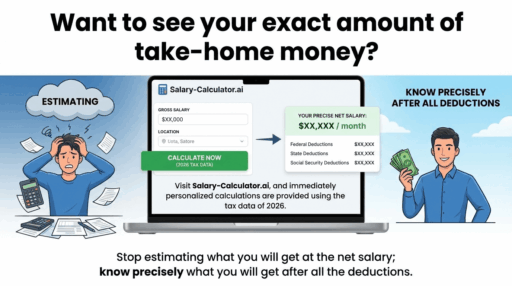

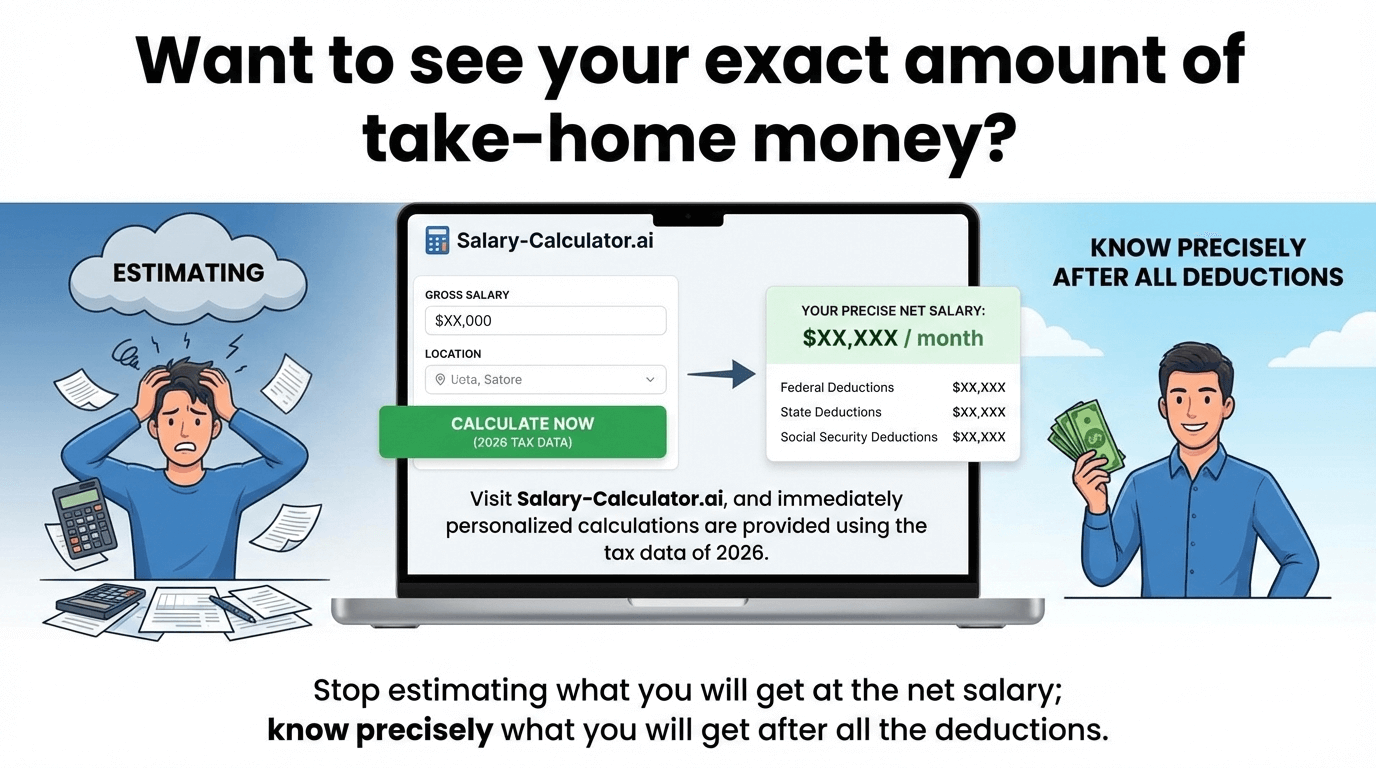

Want to see your exact amount of take-home money? Visit Salary-Calculator.ai, and immediately personalized calculations are provided using the tax data of 2026. Stop estimating what you will get at the net salary; know precisely what you will get after all the deductions.

FAQs:

Q1: How much tax do you pay on $100,000 in the USA?

A single taxpayer who earns a salary of $100,000 in 2026 will pay around $15,000-$16,000 in federal income tax (effective rate of approximately 15-16%), $6200 in Social Security tax, and $1450 in Medicare tax on a $100,000 salary.

Your total FICA taxes equal $7,650. The difference in the state taxes is explosive—the Texas people pay $0, and the California people pay $5500-$7500 based on deductions.

The total amount of tax that you are going to pay is about $22,650-$31,150, but this is inclusive of deductions and other applicable taxes; your take-home will be between $68,850 and $77,350 per year.

Q2: How do you calculate tax in the USA?

The US computation of taxes is of a progressive kind, such that the various portions of income attract various tax rates. Firstly, gross income should be subtracted by the pre-tax deductions (401k, health insurance, HSA) to obtain taxable income.

Then assess taxes as follows: 10% on the first $11,925, 12% on gross income through $48,475, 22% on $103,350, etc., in 2026. Contribute FICA taxes (7.65%-99% of most income), state income tax (0-13.3%), and local taxes. This is a complicated process, which is automatically automated by a federal tax calculator.

Q3: How much tax do I pay if I earn $70,000 a year?

The federal income tax, social security tax, and Medicare tax amount to about $8,900-9,400, $4,340, and $1,015, respectively, at a $70,000 yearly income. You have made a FICA contribution of $5,355.

Add state taxes—from no taxes (no-income-tax states) to high taxes (high-tax states such as California) that are between 0 and $3500-$4500. Non-deductible total tax liability in the range of $14,255-$19,255 ensures you have a net pay of $50,745-$55,745. With the help of a paycheck calculator, you can know the correct numbers depending on your state and deductions.

Q4: How do you calculate federal taxable income?

First of all, in order to determine federal taxable income, your W-2 wage gross income is to be started as total. Less standard deduction ($14,600 in 2026 for single filers) or fewer itemized deductions. Then deduct pre-tax contributions to retirement accounts, health insurance sponsored by the employer, and HSA.

What you are left with is your taxable income—the amount that falls under federal taxation lines. e.g., gross of $75,000 = $14,600 standard deduction = $6,000 401k = $54,400 taxable. The calculation of taxable income is simplified by a taxable income calculator given in real time.