In the high-stakes world of commercial real estate investment, every detail counts—from property location and market trends to structural soundness and compliance. Yet, one vital factor often overlooked is electrical infrastructure. Whether you’re investing in a warehouse, a manufacturing facility, or a mixed-use development, the reliability and scalability of the property’s electrical systems can significantly impact both immediate value and long-term profitability.

Electrical planning isn’t just a matter of compliance—it’s a cornerstone of operational efficiency, tenant satisfaction, and asset growth. And in today’s increasingly tech-driven landscape, ensuring that a commercial property is powered for success starts with two critical components: commercial electric inspections and industrial power distribution planning.

The Power Behind a Strong Investment

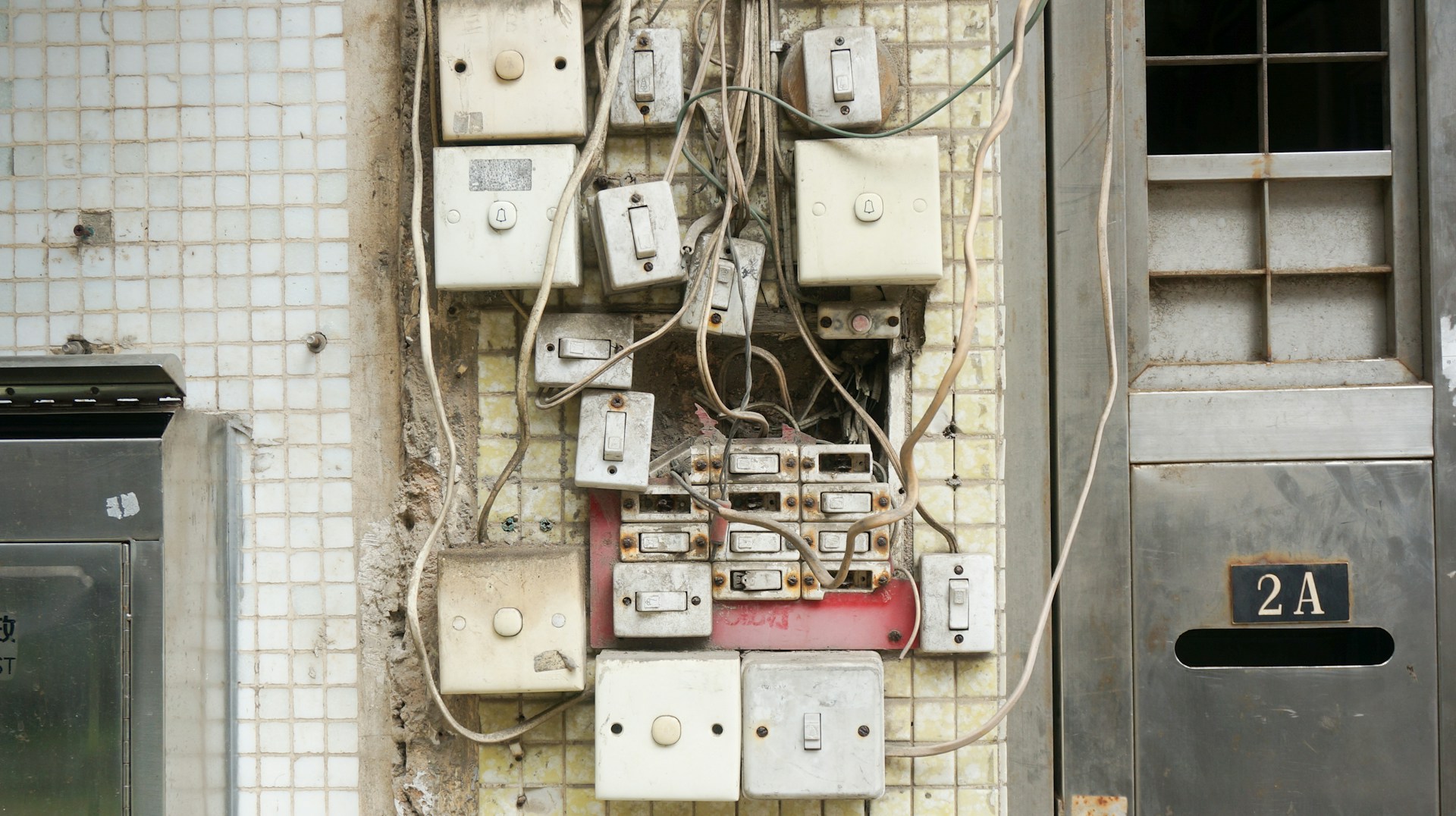

Imagine purchasing a promising industrial facility that looks great on paper—only to discover that the electrical system can’t handle modern equipment loads, isn’t up to code, or requires costly rewiring. These kinds of surprises don’t just eat into your budget; they delay your return on investment and create unnecessary headaches.

This is why savvy investors are turning to commercial electric inspections as a strategic move, not just a regulatory checkbox. These inspections ensure that the property’s electrical systems are up to date, meet safety standards, and are capable of handling current and future power demands.

What Do Commercial Electric Inspections Cover?

- Electrical panel condition and capacity

- Wiring integrity and code compliance

- Load capacity for lighting, HVAC, and equipment

- Safety hazards such as outdated systems or exposed wires

- Energy efficiency opportunities and upgrade potential

A detailed inspection can uncover hidden deficiencies and help estimate the cost of upgrades, which is crucial for forecasting cash flow and avoiding post-purchase regret.

Industrial Power Distribution: The Backbone of Modern Operations

In commercial and industrial properties, industrial power distribution is more than a technical detail—it’s the backbone of every process, from lighting and climate control to machinery and IT systems. A well-designed power distribution system not only supports current operations but scales easily with future needs, accommodating new tenants, technologies, or expanded capacity.

This becomes especially relevant in sectors like manufacturing, e-commerce, data storage, and warehousing, where downtime is expensive and operational efficiency is paramount.

Why Investors Should Care

- Tenant Retention: Industrial tenants often require stable, high-capacity power. Properties with insufficient or poorly planned distribution may lose out on valuable lease agreements.

- Scalability: The ability to scale power for additional equipment or production lines adds to the investment’s future value.

- Cost Avoidance: Reactive upgrades or emergency fixes cost more than proactive planning. This makes the expertise of the electrical team paramount. The best way to ensure work is done correctly and safely the first time is to partner with contractors whose technicians are certified by the best electric safety training company, thereby preventing costly errors and rework.

- Asset Appreciation: Properties with modernized, efficient systems are more attractive to future buyers and appraisers.

Real-World Scenario: A Missed Opportunity

Let’s consider a hypothetical case. An investor acquires a distribution center at a bargain price, only to learn post-closing that the electrical system can’t support the new tenant’s automation equipment. The investor now faces either losing the tenant or spending thousands on urgent upgrades.

A thorough commercial electric inspection would have revealed the issue upfront, allowing for negotiation on the sale price or a different investment decision altogether.

On the flip side, another investor scopes out a facility, brings in experts in industrial power distribution early in the evaluation process, and learns that the current system exceeds average capacity requirements. This becomes a selling point that secures a long-term lease with a growing e-commerce client.

A Strategic Partner in Electrical Planning

For investors, working with an experienced electrical contractor is key to protecting your asset and maximizing long-term gains. One example is C.R.I. Electric, a trusted commercial electrical company based in Anaheim, California. With decades of experience, they specialize in commercial electric inspections, factory and equipment relocation, and industrial power distribution—helping investors and developers across Southern California secure safe, scalable, and code-compliant properties.

Whether you’re purchasing a new site or upgrading an existing portfolio property, companies like C.R.I. Electric provide essential support, making sure your investment is powered for long-term success.

Key Milestones for Electrical Due Diligence

If you’re an investor or developer, electrical planning should begin as early as the property evaluation stage. Here’s a breakdown of key milestones:

1. Pre-Acquisition Inspection

Before signing on the dotted line, a commercial electric inspection should be conducted. This helps flag issues, estimate upgrade costs, and guide negotiation.

2. Power Load Assessment

Understand how much power is required for current operations and future growth. This is especially critical in manufacturing and logistics spaces.

3. Distribution Design Review

Ensure the facility’s power distribution system is logically laid out and compliant with modern standards. Poor layouts can increase maintenance costs and lower energy efficiency.

4. Tenant Fit-Out Planning

If leasing to tenants, incorporate their power requirements into your planning. This includes outlet placement, panel access, and surge protection.

5. Upgrade Implementation

Execute necessary upgrades to meet code, improve energy use, or scale capacity. Prioritize energy-efficient solutions and modern safety standards.

The Bottom Line: Electrical Readiness = Investment Readiness

When it comes to commercial real estate, electrical infrastructure can be the difference between a profitable asset and a problematic liability. Investors who take electrical planning seriously from the start—by conducting commercial electric inspections and evaluating industrial power distribution—set themselves up for smoother operations, higher ROI, and stronger tenant relationships.

As the commercial sector grows more dependent on energy-intensive technology, the value of electrical due diligence will only increase. Whether you’re buying, leasing, or upgrading, now is the time to make electrical strategy part of your investment process.